27 Aug Existing Home Sales, FOMC Minutes, Weekly Jobless Claims, Markit Manufacturing PMI (flash)/ Markit Services PMI (flash), New Home Sales, & More…

Existing Home Sales

Existing home sales ran at a 5.34 million seasonally adjusted annual rate in July, down 0.7% from June. This was the slowest pace since February 2016 and missing the forecast of 5.40 million. Sales of previously owned homes fell for the fourth straight month as supply remained too scarce and prices too high to tempt would be buyers. July’s selling pace was 1.5% lower than a year ago, and at the current sales rate it would take 4.3 months to sell all the available inventory, same as in June, and well below long time historical averages. After a brief uptick in June, inventory was unchanged compared to a year ago in July and down 0.5% for the month. Homes for sale were on the market for an average of 27 days in July up a bit from 26 in June. The median sales price in June was $296,600, up 4.5% compared to July 2017.The lower end of the housing market are being priced out as many potential homebuyers are deciding to sit out on purchasing a home until market conditions change. Frist time home buyers made up 32% of all buyers in July, a tick higher than in June but still well below long-time averages and making no real progress. Notably, distressed sales mad up the lowest share of all transactions, at 3%, since the beginning of tracking this metric in 2008. It is now forecasted 2018 sales will be 1% lower than the 5.51 million homes sold in 2017. The past three years have had exceptionally tight inventory as well as strong price gains; this is visible in both softer demand from stretched buyers and an inventory crisis.

FOMC Minutes

Minutes of the Federal Reserve’s meeting earlier this month signaled broad support for another interest rate hike in September. Many of the members said that if data continues to support their outlook, “it would likely be appropriate to take another step in removing policy accommodation.” But, at the same time, officials said they might have to pause from a gradual rate path if there is an escalation in international trade disputes. The members of the Fed were unanimous in their view that trade disagreements represented a downside risk to the economy.

Weekly Jobless Claims

Initial claims fell slightly in mid-August and hovered near a 49 year low. New claims declined by 2,000 to 210,000 in the week of August 12th to August 18th. Economists had forecasted a higher 215,000 reading. The monthly average a more stable measure of claims slipped by 1,750 to 213,750. The number of people already collecting unemployment benefits, or continuing claims was barely changed at 1.73 million. Th small decline in new claims reflected the third lowest reading during the current nine year economic expansion, just 2,000 above the post recess ion bottom set a month ago. The rate of layoffs in the US haven’t been this low since the first year of Richard Nixon’s presidency in 1969, when the working age population was much smaller. Some economists believe claims could even drop below 200,000 in the near future. The US economy grew steadily despite the ongoing threat of trade wars, a shortage of skilled workers and political turmoil in Washington.

Markit Manufacturing PMI (flash)/ Markit Services PMI (flash)

An index that tracks US manufacturers and service-oriented companies showed slower growth in August, suggesting that economic growth has tapered off from a three year peak in late spring. The flash manufacturing index slipped to a nine month low of 54.5 form 55.3. The services barometer dropped to a four month low of 55.2 from 56. Despite the slowdown, any number over 50 signifies expansion and results above 55 are considered exceptional. Companies are struggling with shortages of skilled labor and in some cases key raw materials due to tariff that have triggered a panic in buying. Transportation costs have also become more expensive because of the difficulty in finding truckers. The biggest problems companies are facing stem from the surging economy. It costs more to employ or hire ne workers and to pay for supplies. The imposition of US and retaliatory foreign tariffs have added to those costs. So long as companies can manage their costs the economy should be fine, but if prices start to rise it will eventually hurt. Manufacturing has led the slowdown, though the service sector has also come off the boil compared to the second quarter highs.

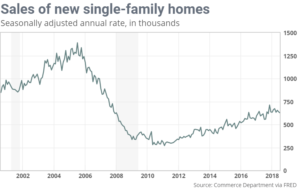

New Home Sales

Sales of newly constructed homes missed economists’ forecasts of 640,000 and revisions of the prior several months were mostly downward. July’s pace was the lowest since last October. It stood 1.7% lower than June sales, but 12.8% higher than a year ago. The median price of new homes sold in July was $328,700. That is only 1.8% higher than the median price in July 2017. The year to date percentage of sales is 7.2% higher than the same period last year. The recovery is still going on in the new home segment of the market and it remains slow. Builders are increasing their pace of construction but again at a slow pace. Tariffs are going to increase input costs, making the road ahead more difficult for the housing market, which desperately needs new supply. Minutes from the Federal Reserve meeting show policymakers discussing housing starts and permits as well as sales of new and existing homes. Housing activity in general has retreated from levels that were temporarily boosted by 2017 natural disasters that forced displaced households to seek alternative housing. The housing sector is also undergoing an adjustment to affordability that is less attractive than it was for most of the cycle, as well as changes in the treatment of SALT deduction in the federal tax code. This is bad news warn economists. The good news is that there is no evidence of the of imbalances that could cause a sharp downturn, such as heavy inventories or rising mortgage default delinquency rates.

Durable Goods Orders/ Core Capital Goods Orders

A big drop in new contracts for passenger jets caused orders for US durable goods to fall in July for the third time in four months. But most manufacturers, aside from Boeing, reported good results and business investment strengthened. Orders for long lasting goods fell 1.7% in July, while economists had forecasted a 1.1% decline in orders for durable goods- goods made to last at least three years. Stripping out planes and cars, orders actually rose 0.2% to mark the sixth increase in a row. Transportation often exaggerates the ups and downs in orders because of lumpy demand from one month to the next. Orders for commercial planes plunged 34% in a widely expected outcome. Boeing typically posts a huge increase in orders early in the summer after the industry’s annual airshow. The airplane builder took in 233 orders in June and just 30 in July. Orders for fighter planes and other military aeronautics also sank, while those for autos and parts rose 3.5%, marking the second straight strong gain. Orders also rose for primary metals, heavy machinery and computers. Business investment accelerated in July despite uncertainty over recently imposed tariffs and the threat of more amid tense negotiations between the US and other key trading partners. Core orders jumped 1.4% last month in the fourth straight gain. They are up a healthy 7.2% in the first seven months of 2018 compared to the same time a year ago. The originally reported 0.8% increase in orders in June was cut to 0.7%. The US economy may have slowed a bit from the second quarter’s pace, but growth still remains strong. Steady business investment is likely to help prolong the expansion. The biggest problem facing manufacturers are higher costs for raw materials and a shortage of skilled workers to fill scores of job openings. Despite the decline in headline orders, the July durable goods data suggest that business equipment investment growth is set to rebound in the third quarter. That provides further reason to think that overall GDP has continues to expand at a healthy 3.0% to 3.5% annualized pace.